Following on from yesterday’s article focusing more on the long-term trends of the UK property market, as opposed to the doom and gloom short-term predictions, we will now take a look at average house prices across the UK and also by English region. There are some very interesting trends in the UK housing market, some of which you would expect but others which will surprise you.

Average house prices by UK country up to May 2017

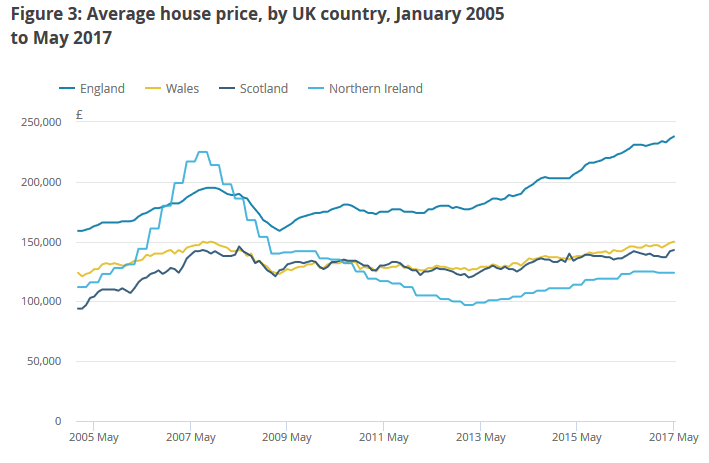

It is fair to say that there has been a massive divergence in house price trends across the various elements of the UK. As the graph below shows, England has been by far and away the most lucrative housing market for many years. However, if you focus on the trend for Northern Ireland this perfectly illustrates the impact which financial assistance from the Northern Ireland government had on the local property market. Northern Ireland was seen by many as the UK housing growth market of the future thereby attracting massive investment, as it happens, over investment. It is only just now that the Northern Ireland property market is recovering to levels last seen back in 2005.

Average house prices by UK country up to May 2017 – Graph courtesy of ONS

All markets across the UK dipped in light of the US sub-prime mortgage collapse but England has certainly recovered faster and stronger than any other part of the UK. The Welsh market is starting to turn upwards again although Scotland is showing weaker growth compared to the rest of the UK. The rise and fall of the Northern Ireland housing market together with the ongoing improvement in English house prices, with the rest dragging behind, just about sums up the last decade.

Average house prices by English region up to May 2017

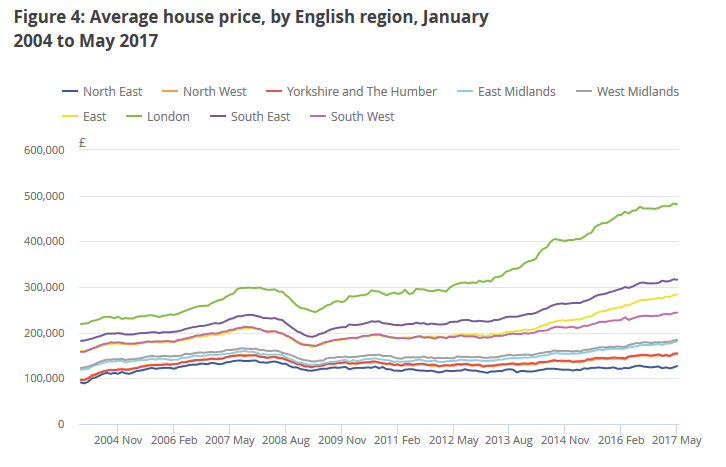

It will come as no surprise to see that London is head and shoulders above any other part of the UK when it comes to house price increases. We have seen average prices in London increase from around the £210,000 in 2004 up to a phenomenal £490,000 in May 2017. The South East and the South West of England have also performed well and, in a surprise to many, the East of England has seen house prices increase steadily. Yorkshire and the Humber together with the North East of England have seen prices pick up from around £100,000 back in 2004 up to £155,000 and £127,000 respectively but their performance lags the rest of England.

Average house prices by English region up to May 2017 – Graph courtesy of ONS

In many ways this graph perfectly illustrates the fact that London is literally a “different market” to the rest of the England and the UK. It will be interesting to see the impact which Brexit negotiations have on London house prices although the weakness of sterling has made this market even more attractive to overseas investors.

Conclusion

It will come as no surprise to learn that England is by far and away the best performing element of the UK housing market and London property prices have been phenomenal in their rise over the last decade. What will surprise many is the rise and fall of the Northern Ireland housing market together with the lacklustre performance of Scotland and Wales compared to England. It will be interesting to see whether those holding property in London and the South of England begin to look further North for “value” or whether they are prepared to ride out the current Brexit storm. What delights does the UK housing market hold for investors in the future?

Link: A snapshot of the UK housing market (part 1)