In many ways it is unfair to compare the rest of the UK to the London property market because to all intents and purposes London is a market in itself. Historically property investors have looked towards London because it has been the hub of the UK economy for centuries. London investment markets lead the world and London is also a vital cog in the worldwide commodities market. Capital appreciation has been central for the vast majority of property investors looking towards the City with rental yields on average significantly less than the rest of the UK.

However, trends are starting to change and while many people point towards Brexit, the seeds of change were planted some time ago.

Better value outside of London

If you look at some of the more affluent areas of London such as Kensington and Chelsea, properties are regularly changing hands at up to 38.5 times annual salaries. The situation is a little more manageable in other areas of the UK at around 7.6 times the average annual salary. The situation in Liverpool is a little different with salaries of around £24,000 and an average house price of just over £115,000. This equates to a multiple of 4.8 times average salary which would indicate good relative value.

When reviewing the London property market, rental yields are around the 3%-4.49% level although there are some areas offering rental yield of less than 1.5%. Looking towards Liverpool, there are a number of opportunities to lock in rental yields of 4.5%-5.99% with some areas offering yields in excess of 6% (HMOs and shared occupancy offer the best rental returns with some in double digits). In light of Brexit and challenges for the London business and property market, we have seen a number of London investors cashing in their “London premium” to acquire larger properties for less money outside of the capital.

When reviewing the London property market, rental yields are around the 3%-4.49% level although there are some areas offering rental yield of less than 1.5%. Looking towards Liverpool, there are a number of opportunities to lock in rental yields of 4.5%-5.99% with some areas offering yields in excess of 6% (HMOs and shared occupancy offer the best rental returns with some in double digits). In light of Brexit and challenges for the London business and property market, we have seen a number of London investors cashing in their “London premium” to acquire larger properties for less money outside of the capital.

Liverpool and its up-and-coming property market

Central to any successful property market is a buoyant economy and low unemployment numbers. Historically Liverpool has suffered more than most with regards to unemployment but recently there has been a surge in the number of new businesses opening up in the area. Liverpool now offers a mix of old and new industries, has a vibrant university community and average economic growth of around 4.8% per annum between 1998 and 2016.

National government and local authorities, together with private investors, have ploughed hundreds of millions of pounds into the redevelopment and regeneration of Liverpool city centre and surrounding neighbourhoods. This has prompted unprecedented demand for private rental properties with shared occupancy the new trend. While Liverpool is often overshadowed by the likes of Manchester, Birmingham and Newcastle, the so-called “Northern powerhouses”, it is now leading the way.

National government and local authorities, together with private investors, have ploughed hundreds of millions of pounds into the redevelopment and regeneration of Liverpool city centre and surrounding neighbourhoods. This has prompted unprecedented demand for private rental properties with shared occupancy the new trend. While Liverpool is often overshadowed by the likes of Manchester, Birmingham and Newcastle, the so-called “Northern powerhouses”, it is now leading the way.

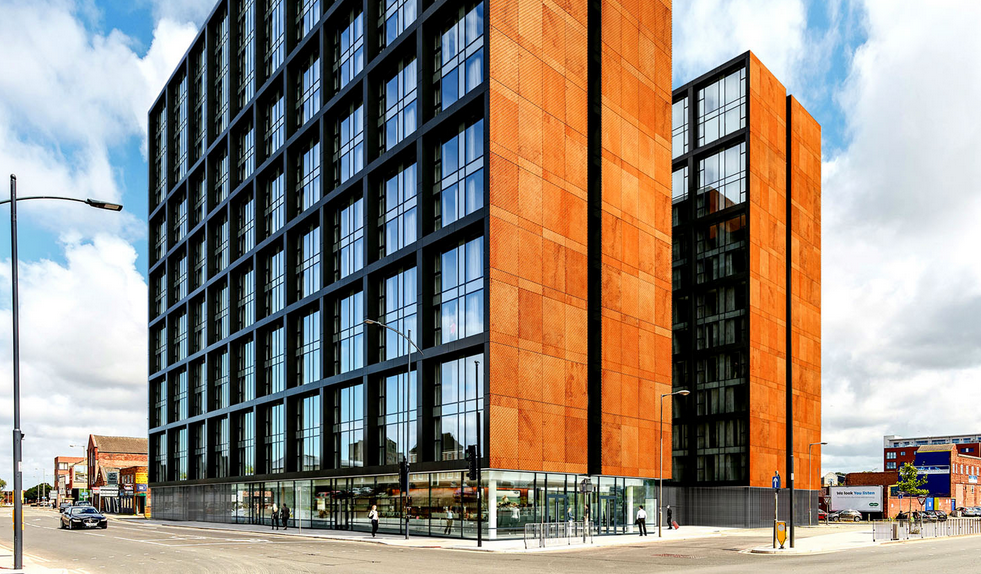

The Metalworks development in Liverpool

Phase 1 of The Metalworks apartment development just off Liverpool’s business district is proving extremely popular amongst investors looking to take advantage of the new trend in shared occupancy. On completion of phase II there will be more than 300 apartments all located within a closed development with an array of shared facilities. High occupancy rates, attractive rental yields and potential for long-term capital growth reflect the high hopes for Liverpool in the short, medium and longer term.