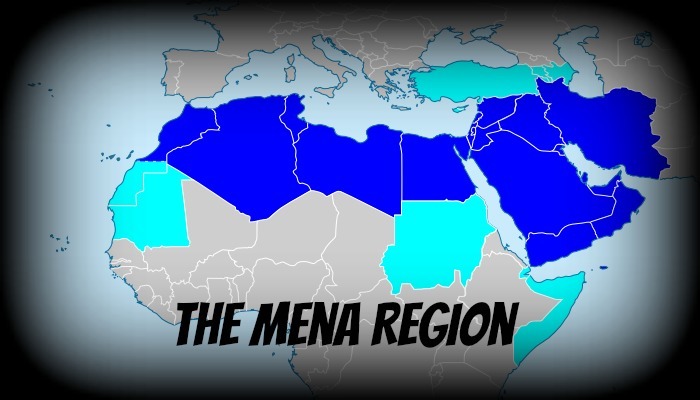

A recent report by JLL has cast a very interesting light on the issue of real estate investment in hospitals and clinics going forward. The report covered what is known as Mena countries (Middle East and North Africa) where the population profile is very different to the OECD. Mena countries currently have around 1.9 hospital beds per 1000 population which does not compare favourably to OECD countries where the figure is 4.8 beds. This would suggest that countries such as Dubai, while often seen as rich and decadent, have been under investing in health care of late.

We are starting to see the emergence of Public Private Partnerships (PPPs) which we have seen in countries such as the UK for many years. So, what does this mean for real estate investors in Mena countries?

Reduction in oil income

Historically areas such as Dubai would have funded infrastructure spending internally using the mountains of oil income which they have enjoyed for many years. The situation has changed dramatically over the last few years with the price of oil dropping as low as $30 although now hovering around the $50 a barrel level. This is nowhere near the level of $100 a barrel seen over the last decade but now seemingly many years away from re-emerging.

This means that governments across the UAE, for example, are more proactive when it comes to PPPs as they take away the financial stresses of funding hospitals and clinics and switch them to the private sector. There will always need to be a return for those taking the risk in the private sector which can come in many forms such as long-term rental agreements as well as servicing arrangements.

Growing market

When you bear a mind that the number of people in Mena countries aged over 65 will increase by 4.4% per annum over the next five years, against 1.9% in OECD countries, this shows the opportunities available. The number of people aged over 65 in Mena countries will increase from 21 million to 26 million by the year 2020.

The report from JLL suggests that an additional 10,000 hospital beds are required across the five major cities of Mena countries (Dubai, Abu Dhabi, Riyadh, Jeddah and Cairo). This is the equivalent of 70 new hospitals which would be an enormous investment by the corresponding governments, which is why the PPP option is now coming to the fore. For the Mena countries to come up to the same level as OECD countries would require a mind blowing 470,000 additional hospital beds which is the equivalent of 3130 new hospitals. So, perhaps the real estate opportunities in the Mena healthcare sector are a little clearer?

The future

Real estate investors are always looking for different angles/opportunities and it seems that healthcare, although not for everybody, could be a very interesting alternative to the traditional real estate market. While the JLL report is a little light on investment returns for the PPPs likely to be on offer it is well-known that Dubai has been extremely investor friendly in years gone by. So, could this be a new opportunity for those looking at real estate investment? A long-term income stream supported by ever increasing demand for healthcare, both domestic and healthcare tourists, sounds just the ticket?