When we talk about mortgages, most of what is discussed revolves around rates, fees, repayment methods, cash back and other incentives, but often the term of the mortgage isn’t looked at in much detail. Too often both consumers and brokers alike, simply refinance to match the term of the mortgage they are replacing.

Is this approach costing UK mortgage holders millions of pounds in additional interest? Could a simple tweak of the mortgage term lead to significant long-term savings?

First-time buyers

It is well documented that the UK property market has proved particularly difficult for first-time buyers. House prices have increased dramatically over the years, and affordability has tightened, leaving first time buyers to stretch their mortgages over 30 or 35 years to secure their dream first property. For many buyers the term of their initial mortgage is not necessarily an option due to upfront costs, deposit requirements and household income in the early years. You must do what you need to do to get that first step on the property ladder.

The problem comes further down the line if home owners don’t review the mortgage term as their financial circumstances change. It should be possible to reduce the term down to something more reasonable over the life of the borrower as (hopefully) household income increases over time.

Compare and contrast mortgage terms

Even though the cost of living increases year on year, wage inflation and overall household income should at least keep pace with inflation in the longer term. Therefore, there should be opportunities along the way to reduce the term of a mortgage. If we look at the following example;

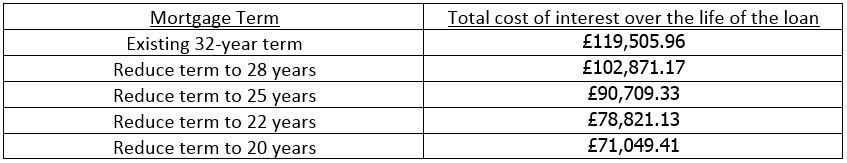

A client purchased their first home for £250,000, putting down a 10% deposit, taking a 35-year mortgage term with a 3 year fixed rate. After 3 years, we are left with a £214,500 mortgage with 32 years remaining. For the purposes of the example we will use an interest rate of 3% for the remainder of the loan.

It is only when you see the facts and figures down on paper and can compare and contrast different mortgage terms that the potential savings become apparent. As you can see from the above illustration, just a 4 year reduction in the mortgage term from 32 to 28 years could save this homeowner £17,000.

Historically low base rates

In today’s low interest rate environment there has been great interest in re-mortgaging at lower rates but significantly less interest in reducing mortgage terms. In many cases it will be possible for homeowners to reduce their mortgage term by a couple of years without any increase in their monthly costs (there may even be scope to reduce existing payments). While the figures above are based on a mortgage rate of 3%, just imagine the savings on a rate of 4%, 5% or higher?

The key to successful refinancing is to consider not only the headline mortgage rate but also the mortgage term. If your finances allow you to reduce the term then potentially you could save yourself thousands of pounds.

If you have any questions on any property finance related matter, you can speak to NM Finance on their dedicated forum www.propertyforum.com/forum/discussions/mortgages.429/