For those property investors who look more towards capital gains as opposed to rental income there may be a tendency to count rent as a “bonus” while pursuing long-term capital growth. For those who depend upon rental income, and less on capital gains, it is even more important to remember inflation when setting your annual rent.

There is a proviso that you can only increase rents in line with demand in the local market – in order to maintain your competitive stance. However, it is also worth remembering that rent reviews should be part of a tenancy agreement so that everybody knows exactly what is happening with no confusion.

Real value of income

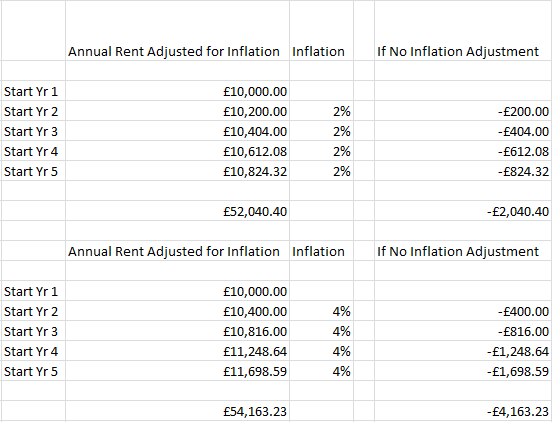

If you have a property which brings in £10,000 a year in rental income and the rate of inflation is currently around 2% per annum, then in theory you need to increase rent by 2% per annum to maintain the status quo in terms of spending power. It may not seem an awful lot of money, an annual 2% increase, but over a five-year period it can be significant. We have put together a table below which shows the impact on real rental income with a 2% rate of inflation and also a 4% rate of inflation.

As you can see, you are not just losing 2% of the base £10,000 rental income per annum but there is the cumulative impact of increasing rent by 2% each year. Could you really afford to give up £2040.40 over a five-year period or even worse, using 4% inflation, £4163.23 over a five-year period?

Other costs

You would also need to take into account any other cost increases, for example, if your insurance charge increased by 10% and all other associated costs increased by the rate of inflation, in real terms you would be out of pocket. When looking at any form of income it is imperative that you appreciate the real value over a prolonged period of time. Maintaining a static income over a period of years will effectively erode the spending power of that income as the cost of living increases by inflation.

Depending on capital gains

Sceptics of this strategy to at least maintain relative spending power of your rental income will no doubt point towards potential long-term capital gains. Yes, history shows that the housing market is still in a long-term upward trend and in theory there is potential for capital gain. However, this will depend upon many factors such as the local, national and international economies not to mention local housing markets, timing of your investment and demand for property.

It is extremely important to ensure the relative long-term value of your income streams. Even though long-term capital gains are traditionally within the grasp of the majority of housing asset investments this is not a given. We only need to look back to the 2008 US mortgage crisis which plunged the worldwide economy into a deep recession from which many countries are only now emerging.

Those who fail to maintain the real value of their rental income over a five-year period would have literally been thousands of pounds out of pocket with the majority of their associated costs rising at least in line with inflation. Imagine the impact if there was a significant increase in the cost of your mortgage payments?