It is fair to say that UK house prices are under pressure after the decision to leave the European Union and the ongoing “troubled” negotiations. When you also throw in a benign economy, also considering the positive performance since the 2008 mortgage crisis, it is perhaps no surprise that sentiment has taken a hit. However, when looking at the bare statistics, what is the real story of UK house prices?

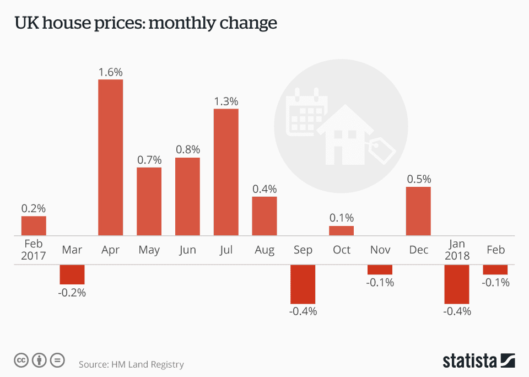

UK house price monthly change

If you look at the graph below you will see that since February 2017 there have only been five months in which house prices are fallen. While the London effect will have impacted the monthly change, it is worth reminding ourselves that these figures do take into account the rest of the UK and everything is on a weighted basis. So, if you look at the basic statistics, yes, the UK market is under pressure but is it really as gloomy as some experts would have you believe?

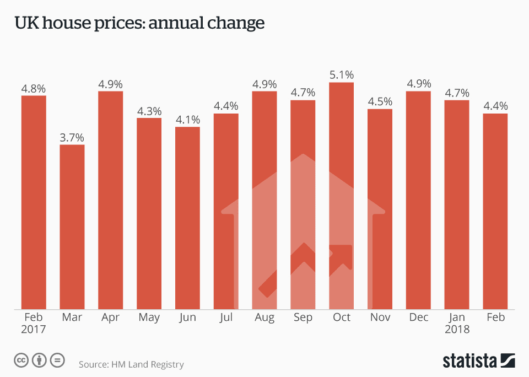

UK house prices annual change

It is fair to say that the annual, and even longer, performance comparisons are more relevant to the property market, investment in which should be considered on a long-term basis. There will be situations where investors are able to “flip” a property to make a short-term gain but on the whole the best performances come from long-term investment strategies. This is perfectly illustrated in the following graph which shows that in the 12 month period to the end of February 2018 UK house prices still increased by 4.4%. Even though this is one of the lower annual increases of late, it is still well above inflation.

It would be foolish to suggest that UK property prices do not have potential for further downside in the short to medium term. It would be misleading to suggest that the worst is over because who really knows what the Brexit negotiations will hold. However, to suggest that the UK housing market is in freefall, prices are plummeting and demand is rock bottom, would appear to be a little wide of the mark?

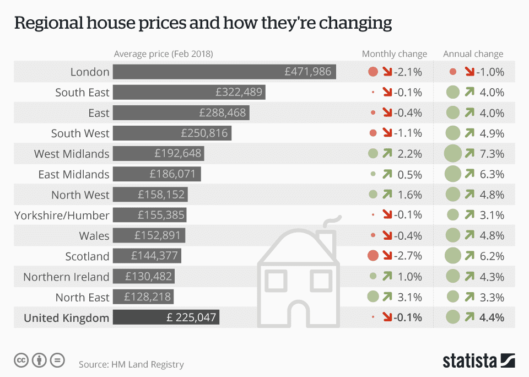

Regional house prices

It is safe to say that the London property market dominates the UK housing market and has done for many years. It is interesting to see that while the London market recently posted an annual 1% fall in property prices (and a more recent 2.1% monthly fall) the UK property market is still in positive territory. We have areas such as the West Midlands posting an annual rise of 7.3%, the East Midlands posting a rise of 6.3% and Scotland (where there are political concerns and a pending independence referendum) posting an increase of 6.2% over the last 12 months.

We are also seeing evidence that London property investors are looking to cash in their “London premium” using funds raised to acquire properties outside of the capital where many deem there to be “better value for money”. This has prompted some experts to suggest the London house price boom is over, investors are looking elsewhere and prices will continue to fall. In reality we have been here on numerous occasions, the London market is hit hardest when the UK hits trouble but time and time again it has bounced back. Will it bounce back this time?

Conclusion

It would be foolish to suggest that the UK property market is not under pressure and investors are not concerned about Brexit, they are. However, when you look at the basic facts and figures relating to UK property prices in recent times it looks nowhere near as bad as some “experts” would have you believe. As they say, what can’t speak can’t lie.