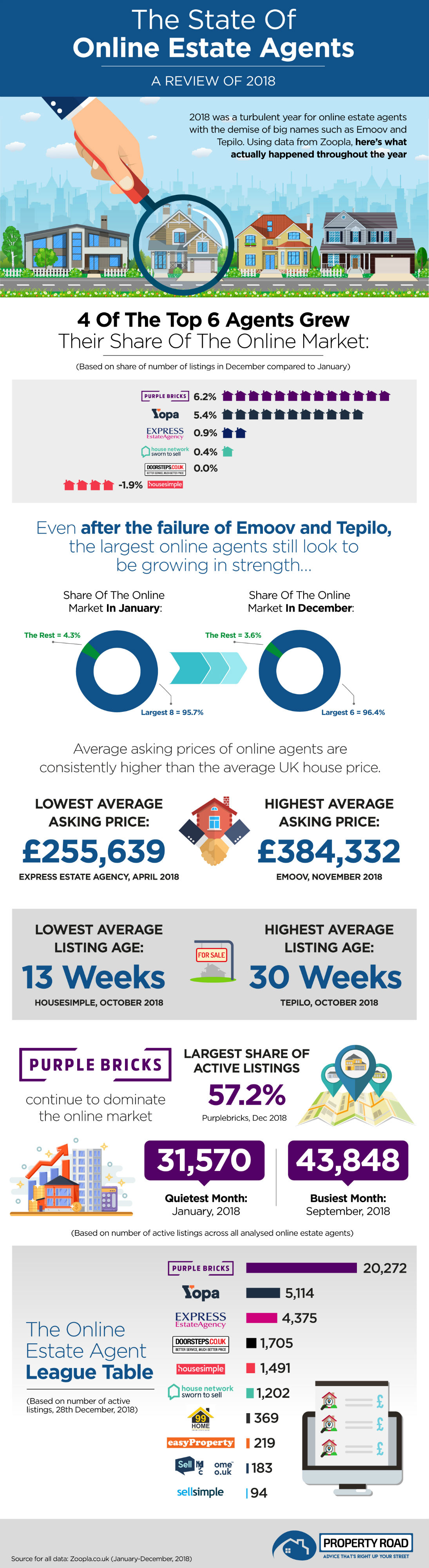

It is fair to say that 2018 was an interesting/active year in the world of online estate agents with the demise of Emoov and Tepilo taking the headlines. This is an area of the market which is extremely competitive and while technology takes centre stage, it is volume of business and additional services which support the income model. As you will see from the following infographic created by Property Road the likes of Purplebricks are going from strength to strength while others such as Housesimple are struggling.

What happened in 2018?

If you work your way through the following infographic, packed with facts and figures, this will give you a summary of 2018. You will then find our analysis of this information, how it has impacted the market and what the future holds.

Infographic provided by www.propertyroad.co.uk

Purplebricks lead the way but Yopa is growing

Those who follow the online estate agent sector will be well aware that Purplebricks has an extremely strong brand name and very active marketing strategy. Therefore it will be no surprise to learn that the company increased its share of the online market from 53.2% in January 2018 up to 59.3% by the end of December. However, delving deeper into the figures the company’s market share was fairly static up until the demise of Emoov and Tepilo towards the end of 2018.

One interesting story which appears to have slipped under the radar of many observers is the expansion of Yopa. The company began 2018 with a 9.6% market share which had grown to 15% by the end of the year. As opposed to a sudden jump towards the end of 2018, the company’s market share had been steadily growing, indicating limited one-off benefits from the demise of Emoov and Tepilo and more organic growth.

In hindsight the switch from Emoov and Tepilo towards Purplebricks could be seen as a flight to quality and a more financially stable company. In reality Purplebricks is head and shoulders above all other market participants boasting four times the number of listings as nearest rival Yopa. It would also be foolish to write off the potential for Express Estate Agency sitting with a market share of 12.8% just behind Yopa.

When the Big 8 became the Big 6

The so-called Big 8 of the online estate agent sector consisted of Purplebricks, Yopa, Emoov, Express Estate Agency, Tepilo, House Network, Housesimple, and Doorsteps at the start of 2018. They boasted a market share of 95.7% between them. As you might have expected, the remaining Big 6 still dominate the market after the demise of Emoov and Tepilo and actually increased their cumulative market share to 96.4% by the year-end.

In hindsight it was inevitable that the original leading group of online estate agents would reduce as competition increased. Indeed, we may well see a further reduction in the leading group especially with a relatively benign UK property market which has to a certain extent been paralysed by Brexit.

High-value property owners attracted to fixed fee model

It is no secret that the majority of online estate agents work on a fixed fee model with only Express Estate Agency maintaining a commission based approach. Interestingly, Express Estate Agency had the lowest average asking price over the year reaching a low of £255,639 in April. Compare this with Tepilo which had the highest average asking price at £370,124 or Emoov which topped the highest individual asking price of the year in November at £384,332. Coincidentally, these were the two companies which encountered fatal financial issues during the year.

There is no doubt that the fixed fee model is widely associated with the online estate agent sector but many may be surprised to learn that Express Estate Agency still utilises the traditional commission based approach.

Duration of listings

This metric was dominated by Housesimple which constantly recorded the lowest average duration of listings hitting just 13 weeks in October. At first glance you would have thought a relatively quick turnover of listings would attract new business but the company’s market share actually fell by 1.9% over the year. There could be other issues impacting the growth of the business but on the surface you would expect companies boasting a relatively short listing time to do well.

On the flipside of the coin, October saw Tepilo recording an average listing time of 30 weeks which was perhaps an indicator of the troubles ahead.

Peaks and troughs of business

It will come as no surprise to learn that September was the busiest month for online estate agent listings with 43,840 active listings recorded on the day the sample was taken. When you consider that Purplebricks accounted for 21,848 of these listings and I Am The Agent just 57, this reflects the chasm between the top and bottom of the sector.

The cumulative listings for January, across the 16 online estate agents involved in the survey, totalled just 31,570. This is no surprise because January is traditionally a relatively quiet month for the sector as a consequence of the festive hangover.

Looking ahead to 2019

It is fair to say that Purplebricks is head and shoulders above its competitors, boasting four times the number of listings of its nearest rival Yopa. Significant investment in marketing and brand awareness by Purplebricks seems to have paid dividends. The strong presence saw the company benefit most from the demise of Emoov and Tepilo towards the end of the year.

While Yopa performed relatively well during 2018, with a 5.4% increase in market share, Express Estate Agency (the leading commission based online group) is hot on the company’s heels. We then have a further group of companies in the shape of Doorsteps.co.uk, Housesimple and House Network fighting amongst each other.

It is likely that the leading online estate agents will continue to dominate the sector but competition and ever-increasing marketing costs will place pressure on relatively thin margins. The fixed cost model depends upon volume although as Brexit comes to a head this could prompt a flurry of activity amongst buyers and sellers in the early part of 2019. History shows that fixed cost models do tend to favour larger companies who are often able to squeeze their smaller competitors. However, even Purplebricks is not immune to financial pressures as marketing costs continue to rise. Nobody is safe….